An oversight in tokenomics can lead to the catastrophic downfall of a crypto project, evaporating millions in value and shaking investor confidence. Understanding these stakes is critical from the outset, as the line between success and failure in the volatile world of cryptocurrency is often razor-thin.

Tokenomics is an essential concept in the world of cryptocurrency, encompassing the economic policies and rules that govern the creation, distribution, and management of digital tokens. At its core, tokenomics is about balancing the complex dynamics of token supply and token value to ensure the long-term sustainability and growth of a crypto ecosystem. This balance is achieved through mechanisms like:

- Vesting

- Token lockup

- Burn mechanisms

- Rewards

These components together drive crypto participation and engagement.

Exploring the Logic of Vesting in Cryptocurrencies

In the dynamic world of cryptocurrencies, vesting emerges as a fundamental strategy to manage token distribution and market stability. From aligning the interests of early investors and project teams to fostering ecosystem growth, understanding vesting's role is crucial for anyone navigating this digital financial frontier.

Understanding Vesting and Token Lockup

Vesting, in the context of tokenomics, refers to the process whereby access to tokens is gradually granted over time. This mechanism, often implemented through token lockup schedules, ensures that the tokens are distributed in a controlled manner, preventing market flooding and preserving token value. Vesting is particularly critical for crypto projects' teams and early investors, as it aligns their interests with the long-term success of the project.

The Benefits of Vesting in Crypto

Vesting offers several benefits in the crypto space:

- Instills discipline among token holders, encouraging a long-term view of investment rather than short-term speculative trading,

- Helps maintain a stable token supply in the market, which is vital for the gradual growth of token value,

- Provides clarity and predictability, which are crucial for investor confidence and ecosystem growth.

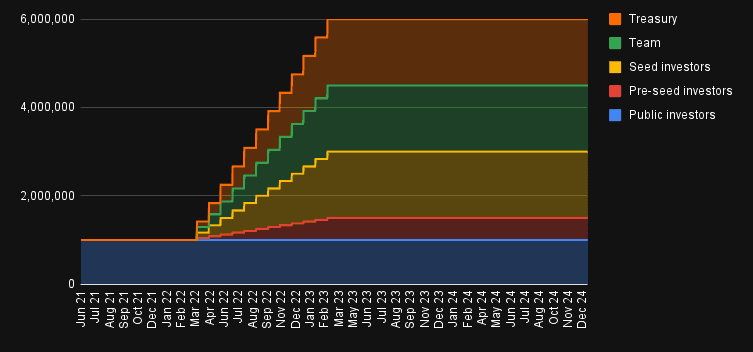

Vesting Schedules and Their Role in Ecosystem Growth

Vesting schedules, which dictate when and how much of the locked tokens become available, play a pivotal role in ecosystem growth. By strategically releasing tokens, these schedules help maintain a balance between supply and demand, fostering a healthy economic environment for the crypto project. This balance is crucial for attracting new participants and retaining existing ones, driving overall engagement in the crypto space.

The Art of Burning: Modulating Token Supply and Amplifying Value

In the realm of cryptocurrencies, the concept of token burning stands as a pivotal strategy for modulating supply and enhancing value. By analyzing the rationale and impact of this practice, we gain insights into its role in fostering a sustainable and valuable cryptocurrency ecosystem.

What is a Burning Mechanism in Cryptocurrency?

Burn mechanisms in tokenomics involve the deliberate removal of a certain quantity of tokens from circulation. This process, often governed by token burn protocols, is akin to a company buying back its shares. By reducing the total supply of tokens, burning mechanisms can lead to an appreciation in token value, assuming demand remains constant or increases.

The Impact of Token Burn Protocols on Token Value

Token burn protocols, when executed effectively, can have a significant impact on the token's value. By reducing the overall supply, these protocols can create a perception of scarcity, which can drive up the value. This tactic is often employed to counteract the effects of inflation or to recover from an excessive initial supply of tokens.

Burning as a Tool for Community Rewards and Engagement

In addition to influencing token value, burning mechanisms can be leveraged as a tool for community rewards and engagement. For instance, a project may burn a portion of its tokens based on community achievements or milestones, creating a sense of participation and ownership among its users. This strategy not only enhances token value but also fosters a stronger bond between the project and its community, promoting long-term engagement.

Reward Mechanisms: Driving Engagement and Participation in the Crypto Space

Reward mechanisms in the cryptocurrency world play a vital role in encouraging user engagement and participation. Understanding these mechanisms is crucial for grasping how they foster a more active and committed community within the crypto ecosystem.

The Role of Rewards in Crypto Participation and Engagement

Rewards play a crucial role in encouraging participation and engagement within a cryptocurrency's ecosystem. These incentives can take various forms, such as staking rewards, mining rewards, or community rewards, and are fundamental in attracting and retaining users. Effective reward mechanisms ensure that participants are adequately compensated for their contributions, whether it's through securing the network, providing liquidity, or engaging in community activities.

Community Rewards and Ecosystem Growth

Community rewards are particularly effective in fostering ecosystem growth. They help build a sense of community and ownership by rewarding users for:

- Participating in community governance

- Content creation

- Other collaborative efforts

This strategy not only promotes active engagement but also drives long-term loyalty and growth, as users feel directly invested in the success of the project.

Balancing Rewards with Token Supply and Value

While rewarding participants is essential, it's crucial to balance these rewards with the overall token supply and value. Over-generous rewards can lead to an oversupply of tokens, potentially diluting their value. Therefore, a well-thought-out reward strategy must align with the tokenomics model, ensuring that rewards contribute positively to the project's long-term viability and the token's value.

Synthesizing Vesting, Burn Mechanisms, and Rewards for Comprehensive Tokenomics

Integrating vesting schedules, token burn mechanisms, and reward systems forms the backbone of effective tokenomics in the cryptocurrency domain. Understanding the interplay between these elements is essential for anyone looking to comprehend or develop a robust and growth-oriented cryptocurrency ecosystem.

Integrating Vesting, Burning, and Rewards in Tokenomics

The integration of vesting, burn mechanisms, and rewards forms the backbone of a robust tokenomics model:

- Vesting schedules ensure a gradual and controlled release of tokens, preserving their value and stability.

- Burn mechanisms modulate the token supply, potentially enhancing their value and creating scarcity.

- Rewards drive engagement and participation, vital for the project's growth and success.

The Synergy of These Mechanisms in Ensuring Token Stability and Growth

The synergy between these mechanisms is critical in ensuring the stability and growth of a cryptocurrency. By carefully balancing these elements, projects can create a sustainable economic model that encourages long-term participation while maintaining a healthy token economy. This balance is key to attracting investors and users who are looking for viable and promising crypto projects.

Reward Strategies and Their Impact on Crypto Engagement

Reward strategies vary widely among crypto projects, each designed to maximize engagement and growth. Staking rewards encourage users to lock their tokens for network security, while liquidity mining rewards incentivize users to provide liquidity to decentralized exchanges. These strategies not only reward participants but also contribute to the overall health and efficiency of the project's ecosystem.

Synthesizing Best Practices in Tokenomics

By synthesizing best practices from these case studies, we can observe a few key trends. Successful projects tend to have a well-balanced approach, integrating vesting, burn mechanisms, and rewards in a way that aligns with their long-term goals. This balance is crucial for sustaining both the token's value and the ecosystem's growth.

Key Takeaways for Structuring Strong Tokenomics

The key takeaway for structuring strong tokenomics lies in the careful balance of supply and demand dynamics. Vesting schedules should be structured to prevent market oversupply, burn mechanisms should be used judiciously to maintain or increase token value, and reward systems must be sustainable and aligned with the project's long-term success. Transparency and predictability in these mechanisms are also important for building trust and credibility in the crypto community.

The Future of Tokenomics: Trends and Innovations

Looking ahead, the future of tokenomics is likely to see more innovations, particularly in how vesting, burn mechanisms, and rewards are implemented. As the crypto space evolves, these elements will continue to play a crucial role in the success and sustainability of projects. Keeping informed of these trends and innovations is essential for anyone involved in the crypto industry, from developers to investors.

The Evolving Landscape of Tokenomics in the Crypto World

The world of cryptocurrency is constantly evolving, and with it, the strategies and models of tokenomics are also undergoing significant transformations. As new technologies emerge and the market matures, the mechanisms of vesting, burning, and rewards are being refined and reimagined to better suit the changing landscape.

The Growing Importance of Tokenomics in Decentralized FinanceThe Growing Importance of Tokenomics in Decentralized Finance

In the rapidly growing sector of DeFi, tokenomics plays a pivotal role. Here, the principles of vesting, token burns, and rewards are not just mechanisms for value stabilization but are integral in creating decentralized governance models. These models empower users with greater control over the direction and decisions of a project, which is a fundamental shift from traditional centralized finance systems.

Innovations in Reward Structures in DeFi Projects

DeFi projects are particularly innovative in their reward structures. Many have introduced mechanisms like yield farming and liquidity mining, where users are rewarded for contributing to the liquidity and stability of the platform. These rewards often come in the form of additional tokens, which can be vested, traded, or used within the ecosystem, creating a dynamic and participative economic model.

Tokenomics in the Context of NFTs and Digital Assets

The rise of NFTs and digital assets has introduced new dimensions to tokenomics. In these realms, vesting and burn mechanisms take on different forms. For instance, NFT projects may include token burns to increase the rarity and value of remaining assets or use vesting to release exclusive content or privileges to holders gradually.

Balancing Scarcity and Accessibility in NFT Tokenomics

An essential aspect of tokenomics in the NFT space is balancing scarcity with accessibility. While burning mechanisms can increase the value of NFTs by making them more scarce, it's crucial to ensure that this doesn't lead to exclusivity that alienates potential users. Similarly, rewards in the form of airdropped NFTs or exclusive access can drive engagement but must be managed to maintain the value and appeal of the assets.

If you're facing challenges in developing the tokenomics of your project, Timacum can offer expert services and solutions. Discuss with our team of specialists by booking a meeting through our contact form, or explore the services we offer.

Future Directions and Challenges in Tokenomics

As the crypto world continues to evolve, the strategies and implementations of tokenomics will face new challenges and opportunities. Understanding and adapting to these changes will be crucial for the success of current and future crypto projects.

Navigating Regulatory Challenges in Tokenomics

One of the significant challenges facing tokenomics is the evolving regulatory landscape. As governments and financial authorities begin to pay more attention to cryptocurrencies, projects will need to navigate these regulations carefully, especially in terms of how they implement vesting, burning, and rewards.

The Role of Community and Governance in Shaping Tokenomics

Finally, the role of community involvement and decentralized governance in shaping tokenomics cannot be overstated. As users become more knowledgeable and involved, their input and participation in decision-making processes will play a critical role in the development and refinement of tokenomic models.

Conclusion

As the cryptocurrency landscape continues to evolve, with emerging trends in DeFi and NFTs, and increasing regulatory attention, the principles of tokenomics will undoubtedly be at the forefront of innovation and adaptation. The future of cryptocurrency, therefore, is not just about technological advancements but equally about the sophistication and effectiveness of its economic models, where vesting, burn mechanisms, and rewards will continue to play a pivotal role in driving engagement, value, and trust within the crypto community.